Florida Real Estate: A Cooling Market, or Just a Return to Earth?

With all the headlines about home prices declining in Florida, some context historical context needs to be put in place

Recent articles highlight the dire situation with Florida real estate, with inventory climbing up and sale prices dropping 1.7% year-over-year.

Home prices in the Sunshine State saw their biggest decline in more than a decade.

The median price for all home types in Florida fell 1.7% in March from the same time last year, according to Redfin, a national real estate brokerage. That’s a small number with big implications.

I think it is quite valuable to take a step back and look at the historical Miami housing situation.

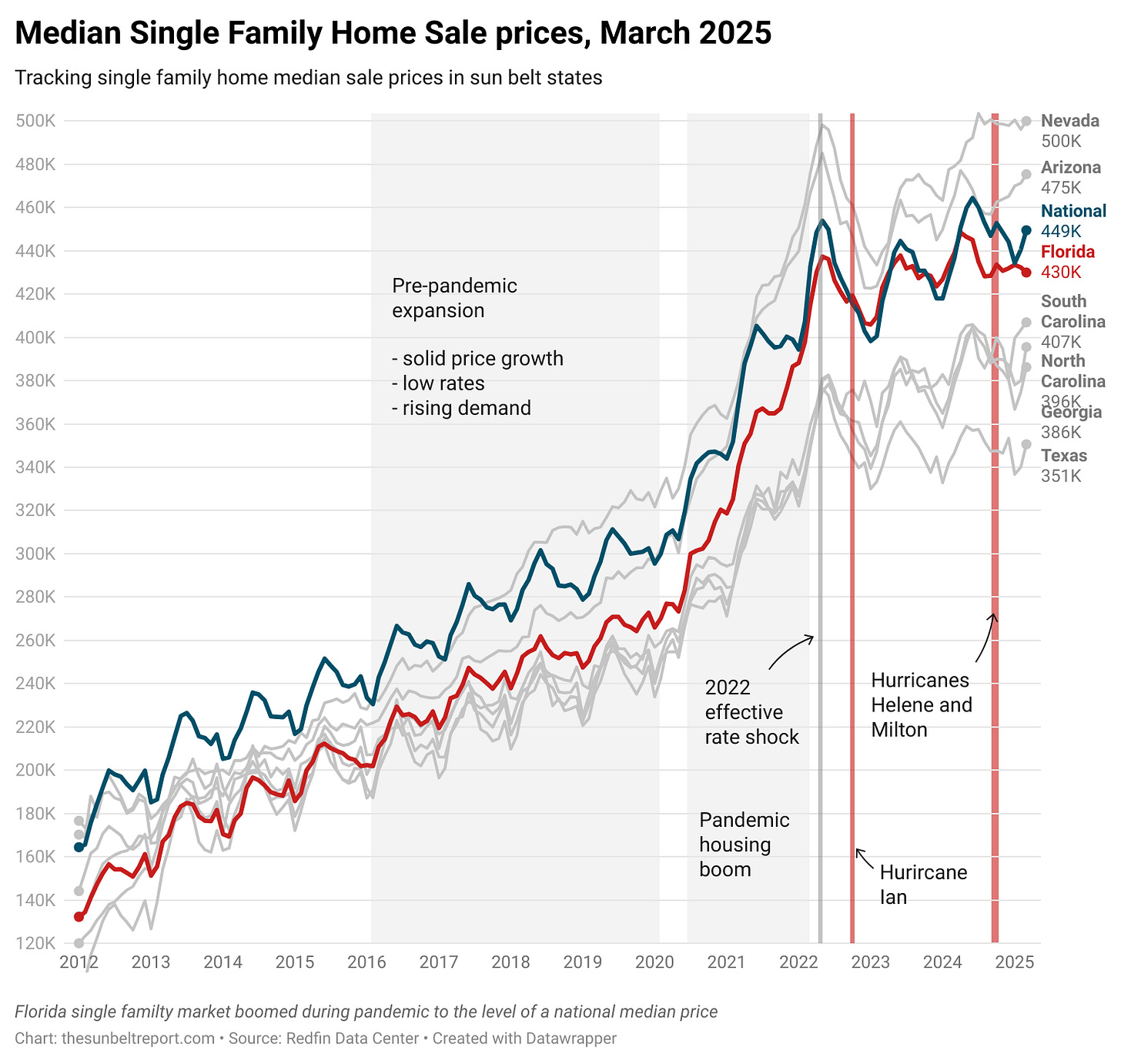

Single Family Homes

Yes, the median price of a single-family home in Florida dipped slightly in March 2025, falling to $429,999 from $439,000 the year prior. However, context matters: this figure is still just shy of the national median of $449,000, a position Florida hasn’t always occupied.

To appreciate how far the market has come, consider this: in March 2020, the median price for a single-family home in Florida was just $277,000. That’s a 69.7% increase over five years—a staggering rise by any standard. Back then, Florida homes were priced about 11% below the national median of $307,400, a gap that had persisted for years.

What we’re seeing now isn’t a collapse—it's gravity taking effect after a period of extreme acceleration. Even with a modest year-over-year decline, today’s prices remain historically elevated. The correction may feel dramatic, but prices are still abnormally high compared to pre-pandemic levels. See chart below:

My point is that while single family home prices declined year-over-year in Florida as of March 2025, single family market right now price-wise, is still abnormally high given the historical context.

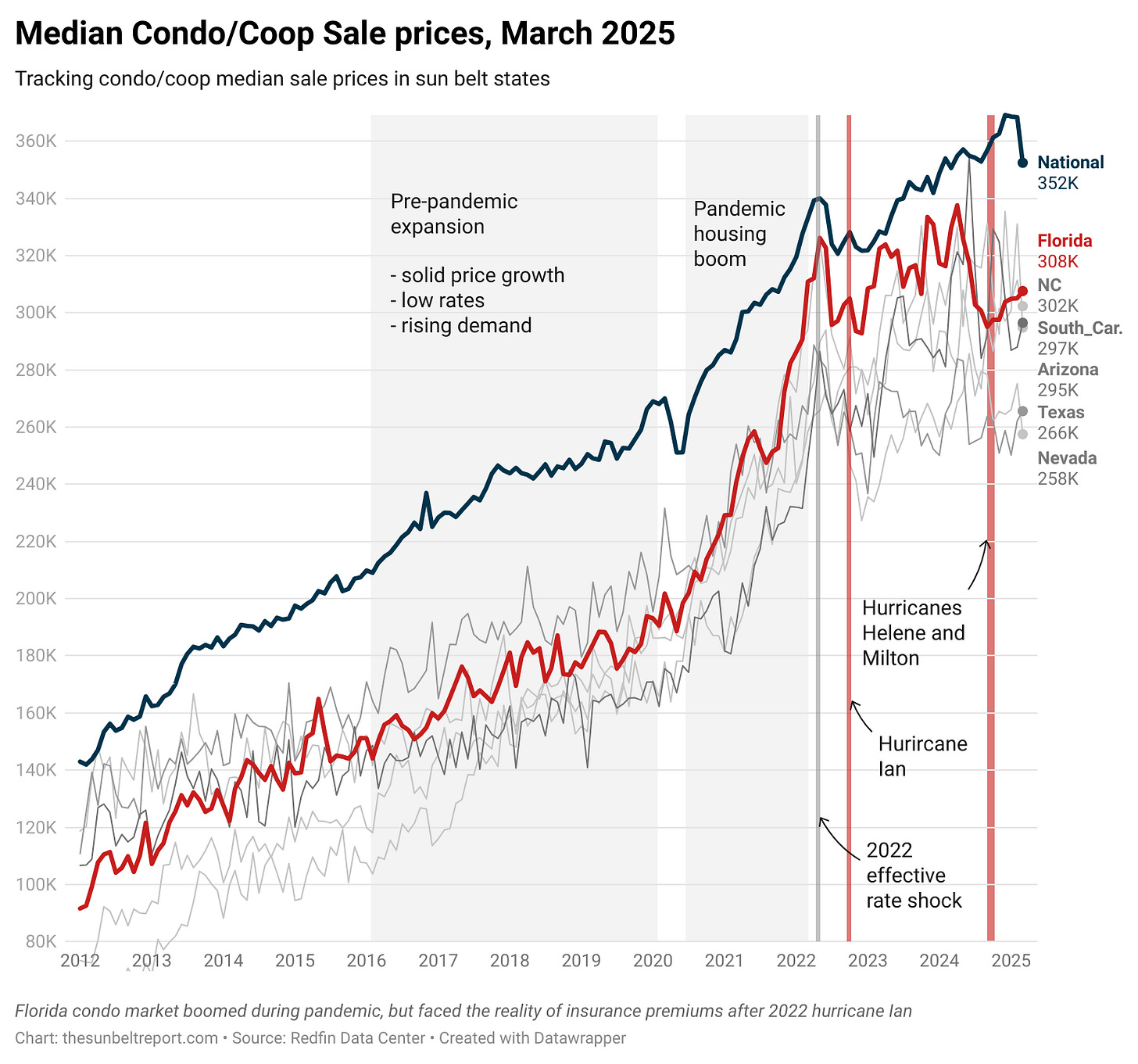

Condo Market

The condo market, meanwhile, is facing more acute challenges. Headlines often point to ballooning HOA fees, rising insurance premiums, and tougher building codes as key pressures—and they’re not wrong.

As of March 2025, Florida condo prices fell 6.7% year-over-year, from $329,800 to $307,600. But this decline, too, must be viewed in light of the meteoric rise that preceded it.

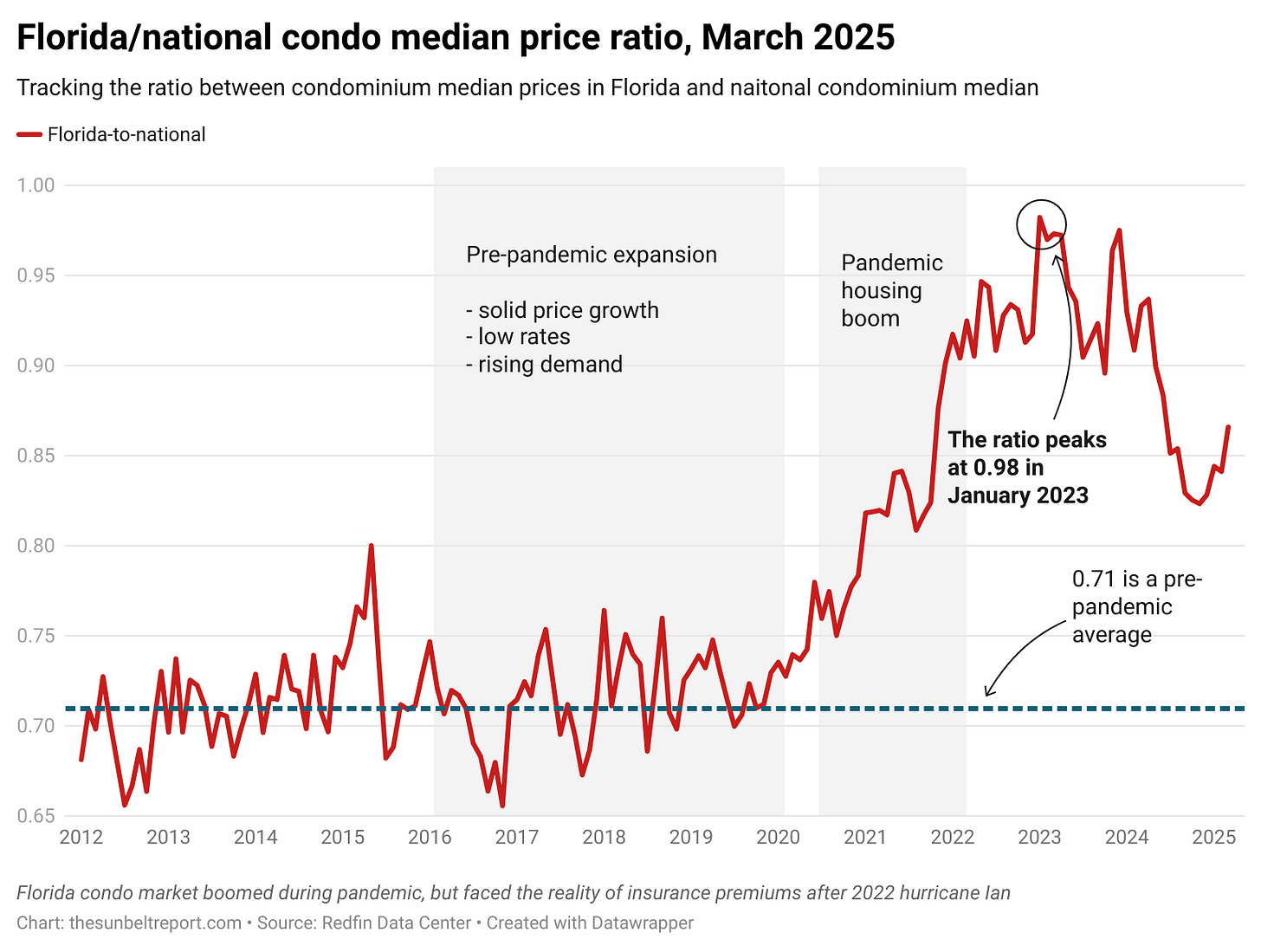

In March 2020, the median condo price in Florida was just $201,800, while the national median stood at $270,000. See chart below

That gave Florida condos a price ratio of just 0.71 relative to the national average. Fast forward to January 2023, and that ratio surged to nearly 0.98—the highest on record. In other words, Florida condos almost caught up with national pricing, a scenario that would have been hard to imagine just a few years earlier.

A Market Rebalancing, Not a Crash

So yes, prices are coming down. But the market is also coming off an extraordinary high. Both the single-family and condo segments in Florida are recalibrating after years of unsustainable growth.

This correction doesn't erase the gains of the past five years—it contextualizes them. For buyers, it might mean more opportunities. For sellers, it’s a reminder that rapid appreciation can’t continue forever. And for policymakers, it's a signal to watch closely—but not necessarily panic.

Sometimes a slowdown is just that: a pause, not a plunge.